ITM Editor, Anna Wood, takes a look into Letters of Credit. What are they, how do they work, and what advantages and disadvantages do they come with?

Recent research conducted by American Express has revealed that half of UK small and medium sized businesses currently operating internationally plan to enter new global markets in the next 12 months. The research revealed that the Covid-19 pandemic has led over 7 in 10 (72%) SMEs to diversify the markets they trade with. European countries, including France, Germany and Spain are topping the list for expansion, but many are looking across the Atlantic, with 20% identifying the US as a target market. This strategy may support growth, with almost three quarters (73%) reporting that doing business internationally creates resilience by providing protection from changing domestic market conditions.

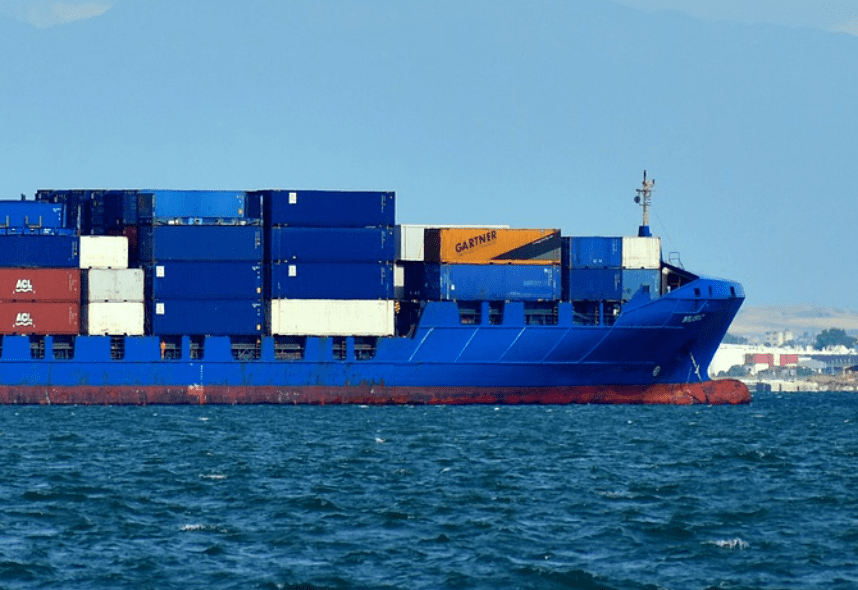

With UK small and medium sized businesses having these plans to diversify the markets that they trade in, there needs to be some sort of security in place. To be able to expand in international trade and gain more business partners throughout the world, the first step is taking a leap of faith. In order for businesses to expand, they need to take chances, both in who they trade with and where these trades take place. But taking a leap of faith without any form of insurance and security behind is a disaster waiting to happen. How can businesses ensure a guaranteed secure trade deal with someone they have never traded with previously?

In these new trade deals, some form of insurance and guarantee is needed to cover these transactions. Rather than these new trade deals being a gamble and a risk, obtaining a negotiable instrument, such as a letter of credit, enables trades to go ahead where reliability and trust may not yet be established. A negotiable instrument is a signed legal document that promises the sum of a payment to an assignee; it is essentially a formalised IOU agreement. It is a transferrable document that promises to pay the bearer a sum of money at a future date, or when demanded. Negotiable instruments aren’t only used in large-scale international trade, but are actually used in day to day life in small scale payments. A personal cheque is a negotiable instrument that is used by regular people and works in a very similar way to the negotiable instruments that are used in international trades. By completing and signing a cheque, the payer is entering a legally binding transaction that the money will be paid to the payee. On the larger scale of international trade, there are specific negotiable instruments that ensure these payments can and will be made.

What is a letter of credit?

A letter of credit is known under multiple names. Also known as a documentary credit, bankers’ commercial credit, and even a letter of undertaking. All of these terms relate to the exact same thing, which in this article will be referred to as a letter of credit for ease of reference.

A letter of credit is a great method of ensuring transactions go to plan. Often in international trade, a letter of credit is used to signify that a payment will be made to the seller on time, and in full, as guaranteed by a bank, or other financial institution. Letters of credit can be used as an extra safety measure when the reliability of contracting parties cannot be readily and easily determined. Oftentimes, they are used at the beginning of a business partnership in order to reduce the risk associated with less established business partnerships and trades. After sending a letter of credit, the bank will charge a fee; this fee is typically a percentage of what the letter of credit is worth, in addition to requiring collateral from the buyer…

Read the rest of this exclusive feature in our latest issue here

Never miss a story… Follow us on:

International Trade Magazine

@itm_magazine

@intrademagazine

Media Contact

Anna Wood

Editor, International Trade Magazine

Tel: +44 (0) 1622 823 922

Email: editor@logistics-buyer.com